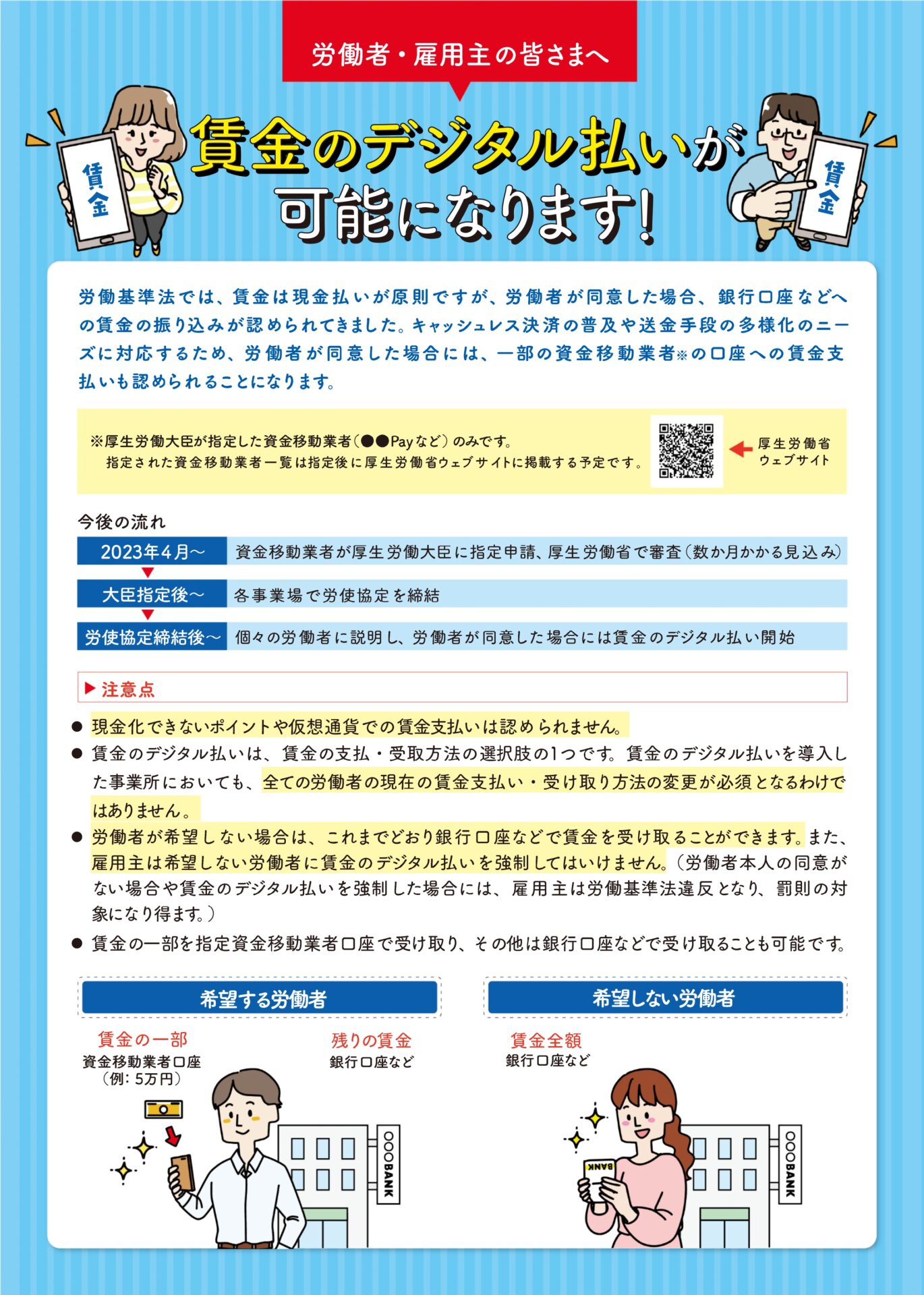

In Japan, a significant shift in wage payment methods is on the horizon with the legalization of “digital salaries” effective April 1 this year. This change allows companies to pay wages through cashless payment accounts like PayPay, revolutionizing the traditional cash-based salary system. Since 1975, salary payments were primarily made in cash, with bank account transfers becoming an accepted method, followed by securities comprehensive accounts in 1998. The addition of cashless payment accounts as an acceptable medium for wage distribution marks a significant evolution.

However, this transition has hit a roadblock. PayPay and other financial transfer service providers like Rakuten Pay and KDDI (au Pay), along with Recruit MUFG Business’s payment brand “COIN+,” applied to the Ministry of Health, Labour, and Welfare to handle digital salaries. Despite initial reports suggesting that the ministry’s review would be completed by summer, over six months have passed without any public updates on the assessment.

This delay is causing a noticeable decline in public interest in digital salaries. Moreover, the ministry’s August 3 announcement of a general competitive bidding titled “Needs Survey Project on Digital Wage Payment for Fiscal Year 2025” has only added to the frustration. The purpose of this survey, scheduled from September 15, 2023, to January 16, 2024, remains unclear, but it implies that the review of the applications might not conclude until mid-January next year.

The delay in implementing digital salaries has significant implications. For financial transfer service providers, managing salaries could facilitate cross-selling of various services. It also aligns with the government’s target of achieving a 40% cashless payment ratio by 2025. For users, it simplifies the process of charging payment apps, eliminating the need for bank transfers or ATM deposits. Companies adopting digital salaries can also enhance their image as progressive and innovative.

However, there’s a palpable lack of enthusiasm among individuals and companies for this new system. If the implementation of digital salaries continues to be postponed, public interest may wane further. Additionally, even after approval from the ministry, companies will need to negotiate labor agreements and obtain employee consent, potentially causing further delays in adoption.

A lesson can be learned from the securities comprehensive accounts for salary payments, which have not seen widespread adoption. To avoid a similar fate for digital salaries, the Ministry of Health, Labour, and Welfare must expedite its review process for financial transfer service providers. The future of digital salaries hangs in the balance, and the ministry’s next steps will be crucial in determining whether this innovative payment method can gain traction in Japan’s evolving economic landscape.

“https://facta.co.jp/article/202312029.html”

Leave a Reply