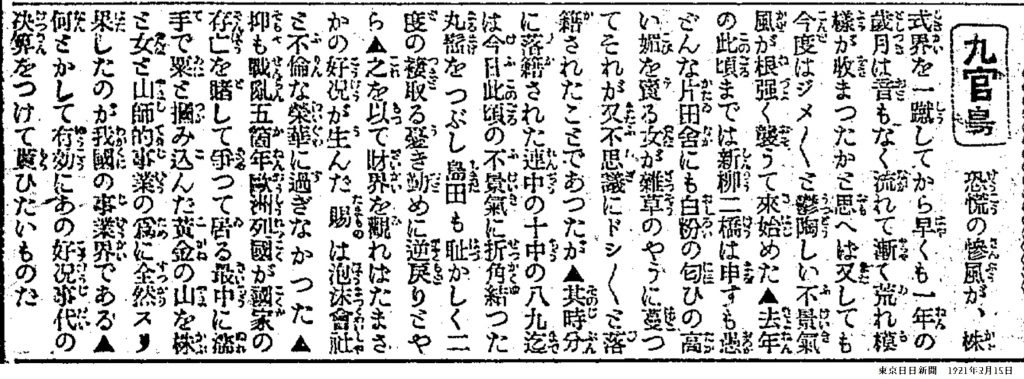

One full year has passed since the stock market crash of the previous year. The bubble-like economic boom caused by World War I quickly turned into an economic depression. The Tokyo Nichinichi Shimbun reports that the situation in the the gay quarters or Geisha World has changed drastically.

The 1920 Depression, which began with the Tokyo stock market crash on March 15, 1920, caused unprecedented price declines and corporate bankruptcies.

The turmoil that began in the stock market led to bank failures and corporate bankruptcies, and from June onward, the depression became a serious condition amid the global economic recession.

The wholesale price index (1900=100) recorded 268 in March 1919 during the post-war truce reaction period, soared nearly 60% to 425 a year later, and then crashed 40% to 251 in April of the following year.

In terms of prices by product during the same period, cotton yarn, cotton products, and raw silk all plummeted by around 70%.

The first characteristic of this depression was that while the United Kingdom and the United States were superficially experiencing a postwar boom until around June 1920, Japan was the first to experience a recession from March.

This was an exception to Japan’s previous depressions, which had been caused by exogenous factors such as plunging overseas markets and sluggish exports.

Secondly, it was triggered by the collapse of speculative trading, which led to the collapse of small and medium-sized trading companies and the closure of local banks on an unprecedented scale.

This made it difficult for trading companies and others with inventories to raise funds (a “liquidity crisis”), and hit the financial institutions that had provided funds for these companies.

As a result, government-affiliated financial institutions, led by the Bank of Japan, began to aggressively provide “cargo finance” (loans secured by unsold goods) to companies in danger of bankruptcy.

In the cotton yarn market, where large-scale speculative trading had been taking place, a number of cotton yarn merchants came to a financial standstill and were liquidated with bailout funds.

The overdue loans covered various business fields, including 48 million yen for cotton yarn cloth, 32 million yen for sugar, 27 million yen for wool, 50 million yen for silk yarn, and 6 million yen for copper.

Thirdly, in connection with this loan, the Bank of Japan encouraged joint actions in each industry to restrict production and dispose of overdue cargo. As a result, cartels were formed in various industrial sectors, and the 1920 Depression provided an opportunity for the development of industrial organization.

The bailout through arrears financing and the promotion of industrial organization were meant to ease the blow of the depression.

However, on the other hand, the extensive bailout loans also preserved companies with weak competitiveness that should have been liquidated in the course of the depression, and this had the adverse effect of turning them into non-performing loans without progress in liquidating their debts.

As a result, the profits of financial institutions deteriorated, and this became one of the roots of the disease that restricted economic development in the 1920s.

Leave a Reply